本期聚焦2025年四季度深圳公募基金行业发展动态,展现行业在政策引导与市场变革下的稳健前行态势。监管层面持续深化公募基金改革,以投资者利益为核心,通过费率优化、合规强化、产品扩容等举措筑牢行业高质量发展基础。深圳辖区公募基金行业表现稳健,资管规模稳中有升。产品创新亮点突出,FOF、债券ETF、公募REITs等品类实现进一步增长。季度分析研讨会围绕“牛市两段论”这一议题展开深入探讨,为股市投资提供前沿思路。此外,各地金融创新政策协同发力,为区域经济与金融高质量发展注入活力。

This issue focuses on the development trends of the public fund industry in Shenzhen in the fourth quarter of 2025, showcasing the industry's steady progress under the guidance of policies and market changes. The regulatory authorities have continuously deepened the reform of public funds, centering on the interests of investors, and strengthening measures such as rate optimization, compliance enhancement, and product expansion to lay a solid foundation for the high-quality development of the industry. The public fund industry in the Shenzhen jurisdiction has performed steadily, with the asset management scale rising steadily. Product innovation highlights are prominent, with further growth in categories such as FOF, bond ETFs, and public REITs. The quarterly analysis seminar delved deeply into the topic of "the two stages of the bull market", providing cutting-edge ideas for stock market investment. Additionally, financial innovation policies in various regions have worked together, injecting vitality into the high-quality development of regional economy and finance.

2025年四季度,深圳投资基金行业坚定践行《推动公募基金高质量发展行动方案》要求,立足服务实体经济与国家战略核心使命,深耕科技金融、绿色金融、普惠金融、养老金融、数字金融五篇大文章,持续优化服务效能、丰富产品供给,助力新质生产力培育与存量资产盘活,为居民多元化财富管理需求提供坚实支撑。为凝聚行业共识、共话发展路径,基金公会于国际财富管理服务中心组织召开了“香蜜湖金融+”之“湾区公募洞察”四季度行业分析研讨会,回顾四季度行业经营情况、发展趋势和热点问题,聚焦市场趋势与投资策略优化,辖区内十数家会员单位参会。

In the fourth quarter of 2025, the investment fund industry in Shenzhen firmly implemented the requirements of the "Action Plan for Promoting High-Quality Development of Publicly Offered Funds", based on the core mission of serving the real economy and national strategies. It focused on deepening five major areas: technology finance, green finance, inclusive finance, pension finance, and digital finance. It continuously optimized service efficiency and enriched product supply, helping to cultivate new productive forces and revitalize existing assets, providing solid support for residents' diversified wealth management needs. To consolidate industry consensus and discuss development paths, the Fund Association organized and held the "Xiangmi Lake Finance+" - "Bay Area Public Fund Insights" fourth-quarter industry analysis seminar at the International Wealth Management Service Center. It reviewed the industry's operating conditions, development trends, and hot issues in the fourth quarter, focusing on market trends and investment strategy optimization. More than ten member units within the jurisdiction participated.

2025 年四季度,金融监管部门持续推进公募基金改革,发布了一系列让利投资者、规范市场生态的政策举措,旨在优化销售结构、降低投资者入场成本、强化投资者保护、规范销售市场秩序,引导长期投资,督促行业机构高质量合规发展,为公募基金行业持续高质量发展奠定坚实基础。

In the fourth quarter of 2025, the financial regulatory authorities continued to promote the reform of public funds, releasing a series of policy measures to benefit investors and regulate the market ecology. The aim was to optimize the sales structure, reduce the entry costs for investors, strengthen investor protection, standardize the sales market order, guide long-term investment, and urge industry institutions to develop in a high-quality and compliant manner. This laid a solid foundation for the sustained high-quality development of the public fund industry.

中国证监会发布3项金融行业推荐性标准,旨在统一证券交易所业务数据元格式、企业ABS业务数据采集口径及期货公司资管业务监管数据报送标准,解决行业数据口径不一、交互效率低、监管监测难等问题,夯实监管数据底座,助力行业数字化进一步规范。

中国证监会修订发布《证券结算风险基金管理办法》,旨在调整计收范围与交纳比例,下调权益类、固定收益类品种及机构提取比例,强化内控与追偿追责,进一步筑牢市场风险防控底线。

中国证监会发布《证券期货违法行为“吹哨人”奖励工作规定》,旨在明确举报涵盖虚假陈述、内幕交易、操纵市场等12类违法行为,分档设置最高100万元的奖金上限,强化“吹哨人”身份匿名保护,严禁打击报复,形成“监管 + 社会监督”的合规合力。

中国证监会发布《证券期货市场监督管理措施实施办法》,旨在明确常用监管措施的实施程序,规范行政和解流程、强化诚信约束,明确不予受理情形及补正期限,平衡监管力度与市场效率,为行业合规发展提供清晰指引。

中国证监会发布《公开募集证券投资基金销售费用管理规定》,旨在分类调降认申购费与销售服务费上限、简化赎回费规则、强化长期投资激励,持续降低投资者成本,引导市场从短期交易向长期配置转型。

中国证监会发布《中国证监会关于推出商业不动产投资信托基金试点的公告》,旨在明确优质零售商业、写字楼等试点范围,要求底层资产权属清晰、现金流稳定,设定基金管理人资质条件,拓宽公募基金业务赛道,丰富资本市场产品供给。

These policies take effect from multiple dimensions such as regulation, risk control, cost reduction, and innovation. By standardizing data formats, optimizing settlement risk prevention and control, strengthening compliance supervision, clarifying regulatory processes, reducing investor costs, and expanding the pilot scope of REITs, they not only lay a solid foundation for industry compliance and digitalization, and strengthen the risk bottom line, but also enrich the supply of capital market products and guide long-term investment, thus laying a solid foundation for the high-quality development of the public fund industry.

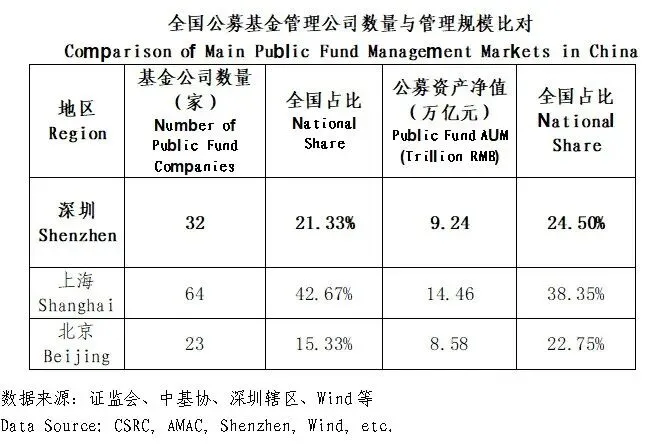

基金公会秘书处回顾了四季度深圳公募基金行业的发展现状。截至四季度末,深圳共有32家公募基金管理公司(按注册地口径统计,下同),占全国基金管理公司总数的 21.33%;公募基金资产净值约9.24万亿元,占全国公募基金资产净值的24.50%。公司数量与管理规模均排名全国第二,仅次于上海。深圳公募基金公司管理非公募业务资产净值合计4.32万亿元,环比下降约1%,其中,社保账户资产净值 1.17万亿元,年金账户资产净值1.06万亿元,养老金账户资产净值0.43万亿元,专户账户资产净值1.66万亿元。

The Secretariat of the Fund Association reviewed the development status of the public fund industry in Shenzhen in the fourth quarter. As of the end of the fourth quarter, there were 32 public fund management companies in Shenzhen (based on the registration location statistics, the same below), accounting for 21.33% of the total number of public fund management companies across the country; the net asset value of public funds was approximately 9.24 trillion yuan, accounting for 24.50% of the total net asset value of public funds across the country. Both the number of companies and the management scale ranked second in the country, only after Shanghai. The total net asset value of non-public fund assets managed by Shenzhen public fund companies was 4.32 trillion yuan, a sequential decrease of about 1%, among which, the net asset value of social security accounts was 1.17 trillion yuan, the net asset value of pension accounts was 1.06 trillion yuan, the net asset value of pension accounts was 0.43 trillion yuan, and the net asset value of special accounts was 1.66 trillion yuan.

四季度,深圳辖区基金公司总资产、净资产进一步提升,盈利稳步增长。截至2025年12月底,深圳基金公司总资产合计1053.57亿元,环比增长2.07%;净资产合计757.91亿元,环比上升2.63%。在盈利能力上,四季度辖区基金公司实现营业收入117.48亿元,环比增长4.82%;净利润29.9亿元。截至2025年12月末,32家基金公司中有24家公司实现盈利,其中,净利润在1亿元以上的有16家。2025年深圳基金公司实现营业收入共计421.07亿元。

In the fourth quarter, the total assets and net assets of the fund companies in the Shenzhen jurisdiction further increased, and their profits steadily grew. As of December 31, 2025, the total assets of the fund companies in Shenzhen amounted to 105.357 billion yuan, up by 2.07% compared with the previous period; the total net assets amounted to 75.791 billion yuan, up by 2.63% compared with the previous period. In terms of profitability, the fund companies in the jurisdiction achieved a revenue of 11.748 billion yuan in the fourth quarter, up by 4.82% compared with the previous period; the net profit was 2.99 billion yuan. As of December 31, 2025, 24 out of 32 fund companies in Shenzhen achieved profitability, among which 16 companies had a net profit of over 100 million yuan. In 2025, the total revenue of the fund companies in Shenzhen was 42.107 billion yuan.

四季度,福田区按注册地口径共有公募基金管理公司 22 家(占深圳 68.75%)。基金公司公募基金资产净值合计 8.15 万亿元(占深圳 88.20%),总资产合计897.09亿元(占深圳 85.15%),营业收入合计102.51亿元(占深圳 87.26%),净利润合计27.21亿元(占深圳 91.00%)。截至2025年12月末,福田22家公募基金管理公司实现营业收入共计359.90亿元。

In the fourth quarter, there were a total of 22 publicly offered fund management companies in Futian District based on the registration location criteria (accounting for 68.75% of those in Shenzhen). The combined net asset value of the publicly offered funds of these fund companies was 8.15 trillion yuan (accounting for 88.20% of those in Shenzhen), the total assets were 89.709 billion yuan (accounting for 85.15% of those in Shenzhen), the total operating income was 10.251 billion yuan (accounting for 87.26% of those in Shenzhen), and the total net profit was 2.721 billion yuan (accounting for 91.00% of those in Shenzhen). As of December 2025, the 22 publicly offered fund management companies in Futian achieved a total operating income of 35.99 billion yuan.

四季度,福田区公募基金公司非公募业务资产净值(包括社保、年金、养老金、专户)共计3.48万亿元(占深圳80.47%),其中社保账户资产净值1.11万亿元,年金账户资产净值1.06万亿元,养老金账户资产净值0.35万亿元,专户账户资产净值0.95万亿元。福田区管理非公募资产逾千亿的基金公司有7家,合计管理非公募资产3.22万亿元,占深圳总额74.54%。

In the fourth quarter, the non-public fund business assets (including social security, pension funds, pensions, and private accounts) of public fund companies in Futian District totaled 3.48 trillion yuan (accounting for 80.47% of Shenzhen's total). Among them, the asset value of social security accounts was 1.11 trillion yuan, the asset value of annuity accounts was 1.06 trillion yuan, the asset value of pension funds was 0.35 trillion yuan, and the asset value of private accounts was 0.95 trillion yuan. There were 7 fund companies in Futian District managing assets exceeding 100 billion yuan for non-public funds, and they collectively managed 3.22 trillion yuan of non-public funds, accounting for 74.54% of Shenzhen's total.

四季度,债券ETF与科创主题产品持续领跑市场,全市场债券ETF总规模突破7000亿元,科创债ETF仍是扩容核心动力。招商基金科创债基金规模稳步攀升,2025年底达200亿元,呼应高质量发展战略;鹏华基金深耕科创ETF赛道,全力打造市场科创领域头部品牌;南方基金季度规模增长284亿元,核心驱动力来自权益类产品与有色金属主题基金,其创新推出的两只数据中心REITs持续发力,还与子公司南方东英联合在新加坡首推中证500基金,实现海外布局突破。

行业机构差异化发展态势鲜明,长城基金债券与固收类基金规模增长200多亿元,成为规模扩张核心支撑;信达澳亚基金2025年9只基金收益率跻身行业前10%;宝盈基金规模略有增长,AI算力与高端制造领域的主动投资为投资者带来正向回报;安信基金QDII基金申请正式获批,业务布局进一步拓宽;前海联合基金承接上海证券两只大集合产品,拟与股东协同发力权益类产品;同泰基金聚焦互联网金融赛道,弥补债券型基金规模下滑缺口;明亚基金推出多款“小而美”新产品,在行业马太效应下寻求差异化突破。

投教活动持续深化,博时基金、平安基金、南方基金等走进高校与中学,通过专题讲座、财商教育等形式,向师生群体普及公募基金知识、培育长期投资理念。

行业同时聚焦投资者多元化需求,从固收增强到海外布局、从科创主题到另类资产,丰富的产品供给为投资者提供了更全面的配置选择,助力财富管理需求精准落地。

In Q4, bond ETFs (total scale exceeding 700 billion yuan) and sci-tech-themed products led the market, with sci-tech bond ETFs as the core growth driver. Key players like China Merchants Fund (sci-tech bond fund hitting 20 billion yuan), Penghua Fund (sci-tech ETF layout), and Southern Fund (28.4 billion yuan quarterly growth, data center REITs, overseas CSI 500 Fund launch) performed prominently.Industry institutions showed distinct differentiated development: Great Wall Fund’s bond/fixed-income scale grew over 20 billion yuan; Cinda Fund had 9 top 10% industry-ranked funds; Baoying Fund gained from AI computing power/high-end manufacturing investments; Anxin Fund expanded via QDII approval; others like Qianhai Union Fund and Mingya Fund sought breakthroughs in equity products and niche offerings.Investor education deepened with Bohi, Ping An, and Southern Funds holding lectures in schools to promote long-term investment concepts. Meanwhile, diversified products (fixed-income enhancement, overseas, sci-tech, alternative assets) met investors’ comprehensive allocation needs.

为帮助深圳公募基金行业把握A股市场周期运行规律、精准研判2026年行情趋势,助力机构优化资产配置策略、提升投资决策效率,本次季度分析会邀请申万宏源证券投资顾问彭斌做专题分享,深度解读“牛市两段论”核心逻辑、当前市场所处阶段特征及后续投资机会与风险。

To assist the public fund industry in Shenzhen in grasping the operating patterns of the A-share market and accurately predicting the market trend in 2026, and to help institutions optimize their asset allocation strategies and enhance investment decision-making efficiency, this quarterly analysis meeting invited Shenwan Hongyuan Securities Investment Advisor Peng Bin to give a special presentation. He will deeply analyze the core logic of the "bull market two-stage theory", the characteristics of the current market stage, and the subsequent investment opportunities and risks.

申万宏源证券投资顾问彭斌在专题分享中提出 “牛市两段论” 核心逻辑,指出当前A股正处于新周期上升阶段。从市场基础来看,A股投资功能加速升级,2021年起分红回购金额已超过股权融资规模,这一趋势持续强化。同时,M1 增速在2024年底触底反弹,反映企业和居民活期资金活跃度提升,市场流动性改善,与经济景气预期形成正向反馈。当前 2025 年主导的科技结构牛已进入“牛市 1.0”中后期,电子、通信、传媒、计算机等板块 PE 接近或超过历史均值 + 1 倍标准差,中长期性价比下降,后续将经历季度级别的高位震荡(平均 84 个交易日,回撤 11.2%)与 “怀疑牛市级调整”(平均 75 个交易日,回撤 21.9%),科技行情需产业催化或业绩验证才能延续。

“牛市 2.0”启动的关键窗口在 2026 年中之后,需满足 “周期搭台、成长唱戏” 的核心条件。供给侧方面,2026年将迎来27个细分行业的历史级别供给出清,涵盖储能、电力设备、医药生物等多个领域,这些行业当前PE处于历史低位,供给出清后需求改善即可推动盈利与股价上涨;需求侧预计将出台大幅度消费刺激政策,缓解供强需弱矛盾,有效缓解通缩压力。

Shenwan Hongyuan Securities investment advisor Peng Bin proposed the "bull market two-stage theory" in a special presentation, noting that A-shares are in a new upward cycle. From the market foundation, A-shares' investment function has upgraded rapidly: since 2021, dividends and share buybacks have exceeded equity financing scale (a strengthening trend), while M1 growth bottomed out and rebounded by end-2024, reflecting improved corporate/residential capital activity and liquidity, aligning with positive economic expectations. The 2025 technology-driven bull market has entered the mid-to-late stage of "bull market 1.0". PE ratios of electronics, communication, media, computer and other sectors have approached or exceeded historical averages plus one standard deviation, with declining long-term value. Future trends will see quarterly high-level oscillations and "suspicious bull market adjustments", requiring industrial catalysis or performance verification to sustain. The key window for "bull market 2.0" is post-mid-2026, needing to meet "cycle as the stage, growth as the show". On the supply side, 27 sub-sectors (energy storage, power equipment, pharmaceuticals, etc.) will undergo historical supply clearance in 2026, with current PEs at historical lows—demand improvement post-clearance will drive profit and stock price gains. On the demand side, expected consumption stimulus policies will alleviate supply-demand contradictions and deflationary pressure.

参会者认为,2025年四季度公募基金行业围绕“合规筑基、价值突围”主线推进,在市场结构分化中锚定投资者长期利益,通过制度完善、产品创新与策略优化,逐步夯实高质量发展基础。

参会者认为,合规与成本优化是行业高质量发展的重要基石,四季度相关费率改革进入关键落地筹备期,全行业已启动存量产品费率梳理与调整,分类调降认申购费与销售服务费上限、简化赎回费规则;同时,相关违法行为举报奖励制度进一步完善了行业合规监督体系,形成“监管+社会监督”合力,从源头保护投资者权益。

市场与产品层面呈现“工具型产品主导增长、特色主题产品填补空白”的鲜明特征。参会者认为,工具型产品中,债券ETF与科创债生态的爆发尤为亮眼,全市场债券ETF总规模突破7000亿元,年内增幅超300%,其中科创债ETF贡献近半数增量,科创债发行规模同步突破1.7万亿元,这背后是AI算力基建、科技创新领域融资需求的强力支撑,相关电力设备、电源设备等环节需求激增推动配置热情。

参会者认为,公募REITs的配置价值在震荡市中进一步凸显,四季度新成立4只、募集规模66.54亿元,其与传统股债资产的低相关性优势显著,部分板块在市场调整期逆势上涨,后续相关试点落地将进一步丰富产品矩阵。

参会者认为,当前市场风险偏好仍处修复阶段,尽管四季度上证指数有所上涨,但权益类基金仍呈净赎回态势,固收类产品与货币基金依旧是行业规模核心支撑。

深圳辖区公募基金行业依托本地产业优势,展现出独特发展活力。参会时多位代表同时提到,本地机构持续推动ETF生态完善与REITs扩容,通过相关产品精准对接科技创新融资需求,探索特色发展方向,同时加大电力设备出海、养老相关产品布局,既服务国家战略,也为投资者创造多元收益机会,助推区域金融与实体经济深度融合。

Industry Focuses on Compliance & Value Enhancement, Collaborative Innovation Empowers High-Quality Development. Participants agree that in Q4 2025, the public fund industry advanced with "compliance as the foundation and value breakthrough" as its core, anchoring investors' long-term interests amid market differentiation and solidifying the foundation for high-quality development through system upgrades, product innovation and strategy optimization. Compliance and cost optimization are key pillars: relevant fee reforms neared implementation in Q4, with the industry adjusting existing product fees (lowering subscription/purchase and service fee caps, simplifying redemption rules). Meanwhile, illegal act reporting reward systems strengthened the "regulation + social supervision" mechanism, safeguarding investors' rights at the source. Market and product highlights centered on "tool-type products leading growth and thematic products filling gaps". Bond ETFs exceeded 700 billion yuan (up over 300% ), with sci-tech bond ETFs contributing nearly half the increment; sci-tech bond issuance topped 1.7 trillion yuan, driven by financing demand in AI computing infrastructure and tech innovation. Public REITs also gained prominence in volatile markets—four new products raised 66.54 billion yuan, leveraging low correlation with traditional assets and countercyclical growth in some sectors, with future pilots to enrich the product matrix. Market risk appetite remains in recovery: despite the Shanghai Composite Index’s slight Q4 gain, equity funds saw net redemptions, with fixed-income products and money market funds supporting industry scale. Shenzhen’s public fund industry thrived on local industrial advantages. Local institutions enhanced the ETF ecosystem and expanded REITs to meet tech innovation financing needs, while boosting overseas power equipment and pension product layouts. These efforts serve national strategies, create diversified investor returns, and deepen regional finance-real economy integration.

四季度,金融创新与政策支持在全国多地持续深化,为经济高质量发展注入强劲动能。10月,北京证监局等六部门在金融街论坛年会发布三份政策文件,核心围绕中长期资金入市、创投股权投资发展、并购重组三大方向激活首都资本市场活力,引导更多长期资本服务实体经济;11月,上海市相关部门召开民营企业座谈会,就四季度施行的《上海市民营经济促进条例》听取企业意见,聚焦结合上海“五个中心”建设优化开放创新环境、完善投融资服务、强化权益保护,以高水平法治优化营商环境;12月,粤港澳大湾区低空经济高质量发展大会上,广东七部门联合发布《关于金融支持广东低空经济集群发展的通知》,聚焦产业全周期金融需求,构建特色化金融服务体系,推出覆盖研发、制造、运营的全链条金融产品,适配应急救援、低空文旅等多元场景提供信贷与保险服务。

在各地政策精准发力与创新实践落地的推动下,四季度我国经济新动能加快培育,金融与产业融合更加紧密,有力支撑区域经济向更高层次迈进,同时也为深圳完善公募基金行业配套政策、强化金融与新质生产力相关产业协同提供了有益参考。从各项指标及行业对比来看,深圳以公募基金为龙头的资管行业在第四季度继续保持良好的稳步上升态势,在规模和产品等方面列于全国头部位置。至此,为2025年的工作画上了较为圆满的句号,同时也为2026年十五五开局之年的各项工作打下了良好的基础。

In the fourth quarter, many regions deepened financial innovation and policy support, injecting strong momentum into high-quality economic development. In October, Beijing’s six departments released three documents at the Financial Street Forum, focusing on medium- and long-term capital entry, venture capital development, and mergers and acquisitions to activate the capital market and guide long-term funds to serve the real economy. In November, Shanghai held a private enterprise symposium on the "Shanghai Promotion Regulations for Private Economy," aiming to optimize the business environment through better opening-up, investment and financing services, and rights protection, aligned with its "Five Centers" construction. In December, Guangdong’s seven departments issued a notice on financial support for low-flying economy at the Greater Bay Area conference, building a full-chain financial service system covering R&D, manufacturing, and operation, with tailored credit and insurance for scenarios like emergency rescue. Driven by precise policies and regional innovations, new economic drivers accelerated, and industry-finance integration deepened, supporting regional economic upgrading and providing references for Shenzhen to improve public fund supporting policies and strengthen synergy between finance and new productive forces-related industries. Shenzhen’s asset management industry led by public funds maintained steady growth in the fourth quarter, ranking among the top nationwide in scale and products, successfully concluding 2025’s work and laying a solid foundation for the "15th Five-Year Plan" opening year.

本次活动是“香蜜湖金融+”专题活动之一。“香蜜湖金融+”专题活动品牌是福田区专门打造的金融领域高端交流平台,联动政府部门、金融机构、行业协会、研究机构等各方力量,常态化、多层次、高水平举办“生态沙龙、名家面对面、前沿峰会”三大模块的系列活动。通过全年不间断的活动,营造最为浓厚的产业氛围和最为活跃的产业生态,支持金融同业深度融合、互促共进,助力福田打造“金融服务新质生产力、代表新质生产力、引领新质生产力”的新质金融高地。

版权声明:

1.本公众号所发布内容,凡注明“原创”等字样的均来源于网络善意转载,版权归原作者所有!已标注“原创”等字样的均为本公众号编撰发布,发布内容包含指导单位、会员单位与合作机构等相关原创内容,如有疑问,请及时与我们联系。

2.除本平台独家和原创,其他内容非本平台立场,不构成投资建议请慎重参考。

3.如千辛万苦未找到原作者或原始出处,请理解并联系我们。

4.文中部分图片源于网络,如有侵权请及时联系我公会删除。

5.本文图片及内容不得私自转载,如需转载或引用,请与我们联系开白,在征得同意后转载请注明作者为“深圳基金公会”。